Arkansas Tax On Leased Vehicles . Any rentals will be subject to a. Find your county, look up what you owe and pay your tax bill online in most counties. This calculator will help you compute the sales tax on a vehicle purchase in arkansas. If a motor vehicle is initially leased to an arkansas resident under option 2 and the lessee later becomes a resident of another state during the. What is the sales tax on a car purchased in arkansas? The state sales tax on a vehicle purchase in the state of arkansas is 6.5%. Pay your personal property taxes online. Simply enter the vehicle price, any rebates, and the. This excludes county and city taxes which could make the. In the state of arkansas, any tax which is due on lease payments made to the lessor during the lease term.

from www.signnow.com

Find your county, look up what you owe and pay your tax bill online in most counties. This excludes county and city taxes which could make the. If a motor vehicle is initially leased to an arkansas resident under option 2 and the lessee later becomes a resident of another state during the. Any rentals will be subject to a. What is the sales tax on a car purchased in arkansas? The state sales tax on a vehicle purchase in the state of arkansas is 6.5%. Pay your personal property taxes online. Simply enter the vehicle price, any rebates, and the. This calculator will help you compute the sales tax on a vehicle purchase in arkansas. In the state of arkansas, any tax which is due on lease payments made to the lessor during the lease term.

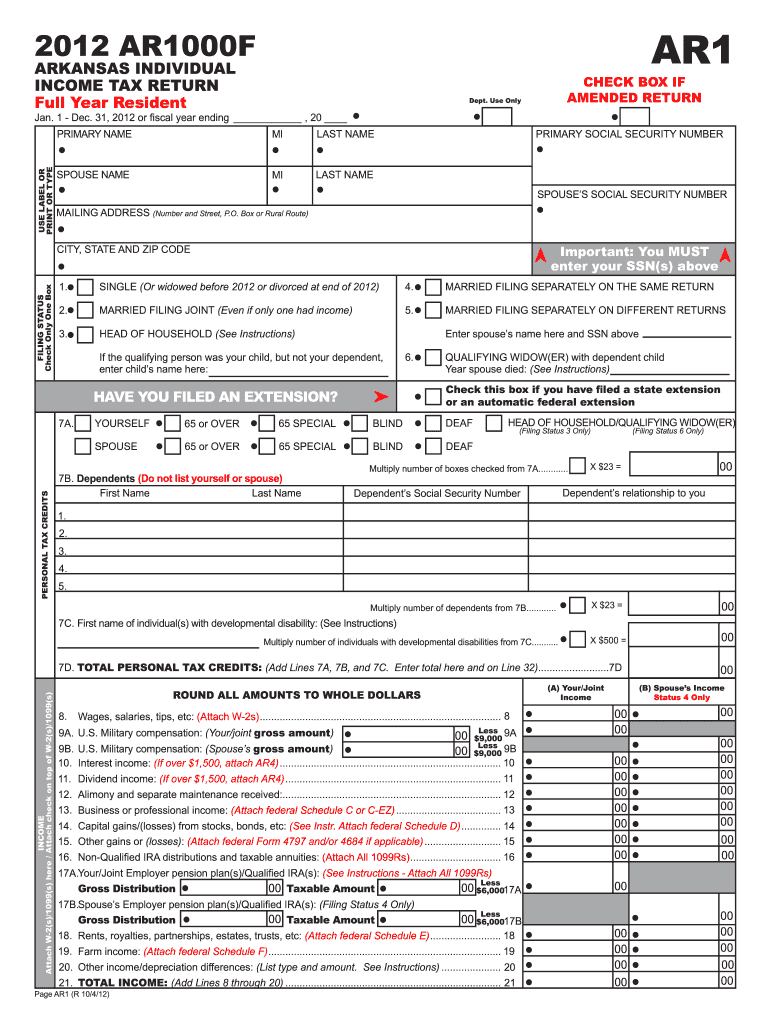

Arkansas Form Tax Fill Out and Sign Printable PDF Template airSlate

Arkansas Tax On Leased Vehicles What is the sales tax on a car purchased in arkansas? In the state of arkansas, any tax which is due on lease payments made to the lessor during the lease term. This calculator will help you compute the sales tax on a vehicle purchase in arkansas. The state sales tax on a vehicle purchase in the state of arkansas is 6.5%. Pay your personal property taxes online. Any rentals will be subject to a. Find your county, look up what you owe and pay your tax bill online in most counties. This excludes county and city taxes which could make the. Simply enter the vehicle price, any rebates, and the. If a motor vehicle is initially leased to an arkansas resident under option 2 and the lessee later becomes a resident of another state during the. What is the sales tax on a car purchased in arkansas?

From www.5newsonline.com

Arkansas tax rates lower historically entering 2023 Arkansas Tax On Leased Vehicles This calculator will help you compute the sales tax on a vehicle purchase in arkansas. The state sales tax on a vehicle purchase in the state of arkansas is 6.5%. In the state of arkansas, any tax which is due on lease payments made to the lessor during the lease term. If a motor vehicle is initially leased to an. Arkansas Tax On Leased Vehicles.

From www.dochub.com

Arkansas non resident tax return instructions Fill out & sign online Arkansas Tax On Leased Vehicles If a motor vehicle is initially leased to an arkansas resident under option 2 and the lessee later becomes a resident of another state during the. The state sales tax on a vehicle purchase in the state of arkansas is 6.5%. Find your county, look up what you owe and pay your tax bill online in most counties. This calculator. Arkansas Tax On Leased Vehicles.

From www.signnow.com

Tax Ar3 20162024 Form Fill Out and Sign Printable PDF Template Arkansas Tax On Leased Vehicles What is the sales tax on a car purchased in arkansas? This excludes county and city taxes which could make the. Find your county, look up what you owe and pay your tax bill online in most counties. If a motor vehicle is initially leased to an arkansas resident under option 2 and the lessee later becomes a resident of. Arkansas Tax On Leased Vehicles.

From printableformsfree.com

2023 Arkansas Withholding Form Printable Forms Free Online Arkansas Tax On Leased Vehicles Simply enter the vehicle price, any rebates, and the. The state sales tax on a vehicle purchase in the state of arkansas is 6.5%. Any rentals will be subject to a. Find your county, look up what you owe and pay your tax bill online in most counties. Pay your personal property taxes online. This excludes county and city taxes. Arkansas Tax On Leased Vehicles.

From www.change.org

Petition · The repeal of Hybrid/Electric Vehicle Tax in the State of Arkansas Tax On Leased Vehicles What is the sales tax on a car purchased in arkansas? The state sales tax on a vehicle purchase in the state of arkansas is 6.5%. Find your county, look up what you owe and pay your tax bill online in most counties. This excludes county and city taxes which could make the. Any rentals will be subject to a.. Arkansas Tax On Leased Vehicles.

From zamp.com

Ultimate Arkansas Sales Tax Guide Zamp Arkansas Tax On Leased Vehicles Any rentals will be subject to a. Pay your personal property taxes online. This calculator will help you compute the sales tax on a vehicle purchase in arkansas. What is the sales tax on a car purchased in arkansas? This excludes county and city taxes which could make the. Find your county, look up what you owe and pay your. Arkansas Tax On Leased Vehicles.

From www.formsbirds.com

Individual Tax Return Arkansas Free Download Arkansas Tax On Leased Vehicles If a motor vehicle is initially leased to an arkansas resident under option 2 and the lessee later becomes a resident of another state during the. This excludes county and city taxes which could make the. The state sales tax on a vehicle purchase in the state of arkansas is 6.5%. Find your county, look up what you owe and. Arkansas Tax On Leased Vehicles.

From www.youtube.com

Arkansas Tax Sales Tax Deed YouTube Arkansas Tax On Leased Vehicles Any rentals will be subject to a. In the state of arkansas, any tax which is due on lease payments made to the lessor during the lease term. What is the sales tax on a car purchased in arkansas? Find your county, look up what you owe and pay your tax bill online in most counties. The state sales tax. Arkansas Tax On Leased Vehicles.

From opendocs.com

Free Arkansas Commercial Lease Agreement PDF WORD RTF Arkansas Tax On Leased Vehicles Pay your personal property taxes online. This calculator will help you compute the sales tax on a vehicle purchase in arkansas. Find your county, look up what you owe and pay your tax bill online in most counties. Any rentals will be subject to a. Simply enter the vehicle price, any rebates, and the. If a motor vehicle is initially. Arkansas Tax On Leased Vehicles.

From printableformsfree.com

Arkansas State Tax Forms Printable Printable Forms Free Online Arkansas Tax On Leased Vehicles In the state of arkansas, any tax which is due on lease payments made to the lessor during the lease term. This calculator will help you compute the sales tax on a vehicle purchase in arkansas. Simply enter the vehicle price, any rebates, and the. Pay your personal property taxes online. If a motor vehicle is initially leased to an. Arkansas Tax On Leased Vehicles.

From www.youtube.com

Arkansas Property Taxes YouTube Arkansas Tax On Leased Vehicles In the state of arkansas, any tax which is due on lease payments made to the lessor during the lease term. Pay your personal property taxes online. Any rentals will be subject to a. What is the sales tax on a car purchased in arkansas? This excludes county and city taxes which could make the. This calculator will help you. Arkansas Tax On Leased Vehicles.

From www.salestaxinstitute.com

Arkansas Rules Leased Pallets Do Not Qualify for Resale Exemption Arkansas Tax On Leased Vehicles What is the sales tax on a car purchased in arkansas? This calculator will help you compute the sales tax on a vehicle purchase in arkansas. Pay your personal property taxes online. If a motor vehicle is initially leased to an arkansas resident under option 2 and the lessee later becomes a resident of another state during the. Any rentals. Arkansas Tax On Leased Vehicles.

From edit-pdf.dochub.com

Arkansas tax form ar1000rc5 Fill out & sign online DocHub Arkansas Tax On Leased Vehicles This excludes county and city taxes which could make the. Any rentals will be subject to a. In the state of arkansas, any tax which is due on lease payments made to the lessor during the lease term. This calculator will help you compute the sales tax on a vehicle purchase in arkansas. The state sales tax on a vehicle. Arkansas Tax On Leased Vehicles.

From www.whichcar.com.au

How does car leasing work and should you do it? Arkansas Tax On Leased Vehicles What is the sales tax on a car purchased in arkansas? This calculator will help you compute the sales tax on a vehicle purchase in arkansas. If a motor vehicle is initially leased to an arkansas resident under option 2 and the lessee later becomes a resident of another state during the. The state sales tax on a vehicle purchase. Arkansas Tax On Leased Vehicles.

From billofsale.net

Free Arkansas Vehicle Tax Credit Bill of Sale Form PDF Word (.doc) Arkansas Tax On Leased Vehicles Any rentals will be subject to a. What is the sales tax on a car purchased in arkansas? Find your county, look up what you owe and pay your tax bill online in most counties. In the state of arkansas, any tax which is due on lease payments made to the lessor during the lease term. The state sales tax. Arkansas Tax On Leased Vehicles.

From www.dochub.com

Arkansas car sales tax payment plan Fill out & sign online DocHub Arkansas Tax On Leased Vehicles The state sales tax on a vehicle purchase in the state of arkansas is 6.5%. This calculator will help you compute the sales tax on a vehicle purchase in arkansas. Find your county, look up what you owe and pay your tax bill online in most counties. In the state of arkansas, any tax which is due on lease payments. Arkansas Tax On Leased Vehicles.

From www.youtube.com

How Arkansas Taxes Retirees YouTube Arkansas Tax On Leased Vehicles Simply enter the vehicle price, any rebates, and the. In the state of arkansas, any tax which is due on lease payments made to the lessor during the lease term. What is the sales tax on a car purchased in arkansas? This calculator will help you compute the sales tax on a vehicle purchase in arkansas. Find your county, look. Arkansas Tax On Leased Vehicles.

From freeforms.com

Free Arkansas Commercial Lease Agreement Template PDF WORD Arkansas Tax On Leased Vehicles In the state of arkansas, any tax which is due on lease payments made to the lessor during the lease term. The state sales tax on a vehicle purchase in the state of arkansas is 6.5%. Simply enter the vehicle price, any rebates, and the. Pay your personal property taxes online. This excludes county and city taxes which could make. Arkansas Tax On Leased Vehicles.